avant credit card apply

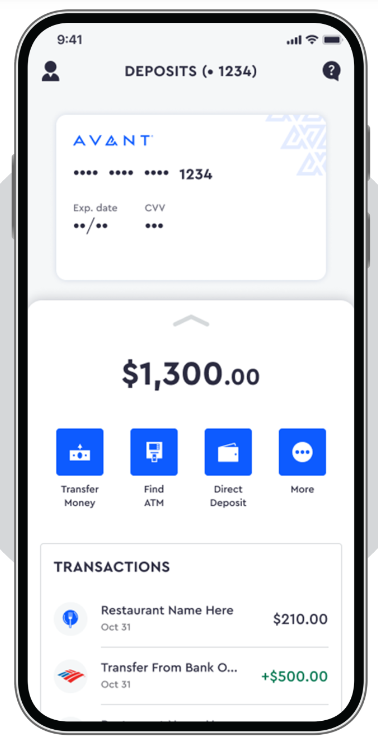

In this Avant credit card review, we will certainly go over whether this card is a excellent suitable for those with a limited credit rating. Although the AvantCard does not impact your credit report when you apply, it is an unsafe product that does have a small credit line The Avant Personal Loan 2022, on the other hand, does not need a credit report in all. The customer testimonials as well as contrast graph below must be helpful for those who are taking into consideration getting this personal loan.

The Avant credit card is a solid alternative for a credit-building individual with fair to typical credit history. The annual fee is inexpensive and the credit line is a good beginning factor. The Avant card also allows you to prequalify without a hard pull on your credit score. As long as you are over the age of eighteen, this sort of credit card is an excellent option for developing a strong credit rating. The Avant credit card review additionally highlights the benefits and also drawbacks of this credit card.